Facture électronique : comment convaincre ses fournisseurs ?

Vous voulez vous lancer dans la dématérialisation des factures fournisseurs ? Vous vous demandez comment convaincre vos fournisseurs de vous suivre dans cette évolution ? Concrètement, avec la facture électronique, quels sont les avantages pour vos fournisseurs ? La réussite de votre projet dépendra de votre capacité à mener correctement cette transition. Et pour cela, la coopération de vos fournisseurs est nécessaire. Car si vous voulez recevoir vos factures dans un format électronique, il va falloir que vos fournisseurs vous les envoient de manière dématérialisée.

Et plus vous réussirez à convaincre vos fournisseurs, plus vous obtiendrez un retour sur investissement élevé. Cependant les habitudes ne sont pas faciles à changer. Alors comment convaincre ses fournisseurs ? Avec la facture électronique, quels sont les avantages pour eux ?

On vous donne ici quelques clés pour amener vos fournisseurs à percevoir les bénéfices de la facture électronique pour eux et à adhérer à votre transformation.

Pour les fournisseurs : un coût d’utilisation de 0€

La première étape pour convaincre vos fournisseurs d’adhérer à la facture électronique, c’est qu’il n’y ait pas de surcoût supplémentaire lié à l’utilisation de votre solution.

Pour les fournisseurs, l’accès à une plateforme de collecte des factures telle que Freedz est gratuite !

La première barrière est levée ! Pourquoi s’opposer à utiliser une solution qui ne leur coûte rien ? D’autant plus que les bénéfices pour les fournisseurs vont bien au-delà de ce simple fait et présentent de réels avantages.

On vous en dit plus sur les autres points qui vous permettront de convaincre vos fournisseurs d’adopter la facture électronique !

L’atout n°1 pour convaincre ses fournisseurs : réduire ses délais de paiement !

Pour convaincre vos fournisseurs, il faut comprendre leur principal problème au niveau de la facturation : les délais de paiement !

En France, 1/4 des faillites d’entreprises sont dues à des délais de paiement trop long (selon une étude de l’Observatoire des délais de paiement). En 2018, ces délais des entreprises françaises atteignent 73 jours. Par rapport à l’année 2017, cela correspond à un rallongement de 2 jours supplémentaires !

Sécurisation du transport et accélération des temps de traitement

La première cause de ces retards est liée aux temps de traitements trop longs des factures papier ou PDF gérées manuellement. Une facture sous format papier doit être imprimée en plusieurs exemplaires (au minimum, une copie pour l’émetteur et une pour le client). Ce qui suggère des frais d’édition, ainsi que des frais d’envoi. Et cette facture papier mettra au minimum 3 jours pour être délivrée par la poste, si elle arrive (alors qu’un envoi électronique prend quelques secondes). Elle n’atteindra pas tout de suite le destinataire… Une fois reçu, le courrier doit être trié, la facture papier est scannée, saisie, traitée avant d’être envoyée dans le service concerné pour validation puis retournée au service financier, pour peu que celle-ci ne reste pas « dormante » dans un bureau…

La facture doit ensuite être conservée sur une durée fiscale de 6 ans minimum et, juridiquement sur 10 ans minimum. Or, ces délais de conservation impliquent un archivage. Une aussi longue période de conservation et la lourdeur du traitement manuel amènent inévitablement des pertes de documents. En 2017, selon une étude de Kodak Alaris, 7,5% des documents papiers gérés par une entreprise se perdent. Un autre problème qui peut être rencontré est le temps perdu à rechercher un document mal classé (en 2017, 3% des documents gérés par une entreprise sont mal classés, selon la même étude).

Bref, ces diverses raisons chronophages ont bien souvent un coût pour vous, et rallongent les délais de paiement pour vos fournisseurs. On comprend aisément que ces tâches sont contre-productives. Elles incitent à changer la manière de gérer la facturation : passer du support papier vers un format électronique, d’un traitement manuel vers une démarche automatisée.

Réduction des erreurs de saisie

Autre cause des retards de paiement des factures : le rejet des factures non conformes. Selon une étude d’Aberdeen Group, 8 factures fournisseurs sur 10 présentent au moins une erreur de saisie.

Effectivement, une faute d’inattention est vite arrivée ! Les anomalies rencontrées sont nombreuses : erreurs dans les coordonnées, les chiffres ou les calculs (remise ou TVA non faite ou erronée)… La gestion manuelle implique aussi d’être attentif aux changements législatifs.

L’équipe comptable est la mieux placée pour savoir qu’une donnée incorrecte peut mener à une perte de temps incroyable. Le temps passé à la vérification et à la résolution des erreurs pourrait être employé sur d’autres activités. Car chaque faute sur une facture papier doit être corrigée. Sous-entendu : le document doit être repris, réimprimé et envoyé à nouveau. Pour peu que les fournisseurs aient bien été informés rapidement du rejet et de sa cause…

Une plateforme de collecte de factures telle que Freedz permet de contrôler la fiabilité des données envoyées, garantissant ainsi la valeur légale des factures.

Les problèmes potentiels sont donc repérés avant que les factures ne rentrent dans votre circuit d’approbation et de traitement. Abandonner le papier et la saisie manuelle pour une saisie électronique et automatisée permet d’éviter les erreurs de saisie ou de lecture lad/rad.

En limitant les allers-retours, la facture électronique permet un traitement des factures plus rapide et plus fiable. Les retards de paiement sont réduits. Les entreprises se mettent moins en danger, et par conséquent, les relations client-fournisseurs s’améliorent.

La réduction des délais de paiement est un objectif atteignable grâce à la réduction des temps de traitement. Ceci est réalisable avec la facture électronique qui présente donc des avantages certains pour vos fournisseurs.

En effet, la réception et le traitement des factures fournisseurs dans un format électronique permet une accélération du temps de traitement par 4 (selon une étude du cabinet Ernst & Young).

Enfin, tout le monde est gagnant ! Une accélération de vos délais de paiement se traduit par moins de pénalités de retard, voire des réductions pour paiement anticipé ! C’est une garantie de payer dans les temps, ce qui signifie pour vous une trésorerie à jour.

Une traçabilité accrue

La facturation électronique, c’est une traçabilité fiable et donc un gain de temps assuré.

En effet, une plateforme de collecte des factures telle que Freedz permet de tenir vos fournisseurs informés du statut de traitement des factures déposées. Depuis leur compte utilisateur, ils disposent d’un accès à un tableau de bord permettant de suivre les statuts de traitement de leurs factures, et bénéficient donc d’un meilleur suivi. L’échange d’informations est automatique et bilatéral. Il permet de mettre fin aux appels de demande d’informations, pour savoir où en est une facture.

L’utilisation de la facture électronique sécurise l’envoi et le transport des factures, offrant une traçabilité qui supprime les pertes de documents.

Une réduction des litiges et une amélioration des relations fournisseurs

Auparavant, les relations client-fournisseurs pouvaient être tendues (notamment avec l’allongement des délais de paiement). Récemment, conscientes que ces frictions sont dommageables pour tout le monde, les entreprises changent d’attitude et cherchent à améliorer ces relations.

En effet, comme nous l’avons signalé plus tôt, grâce au tableau de bord les fournisseurs sont tenus au courant du statut de traitement de leurs factures. Fini les appels de leur part afin de savoir où en est leur facture. Vous avez moins de préoccupations et eux aussi. De plus, la fiabilisation des données limite les erreurs et les rejets de facture, et donc les sources de litiges avec vos fournisseurs. Les rapports avec eux deviennent dès lors plus détendus. Une confiance s’installe à travers l’outil, et permet une collaboration entre vous et vos fournisseurs, donc une amélioration des relations. La facture électronique permet donc de dire stop aux relations conflictuelles.

Et si un litige survient tout de même ? Le format électronique améliore la traçabilité. Il devient plus facile de détecter les blocages, d’identifier rapidement les sources de litiges et donc d’en accélérer le traitement, de la déclaration à leur résolution.

Coup de grâce pour achever de convaincre vos fournisseurs : c’est un avantage concurrentiel

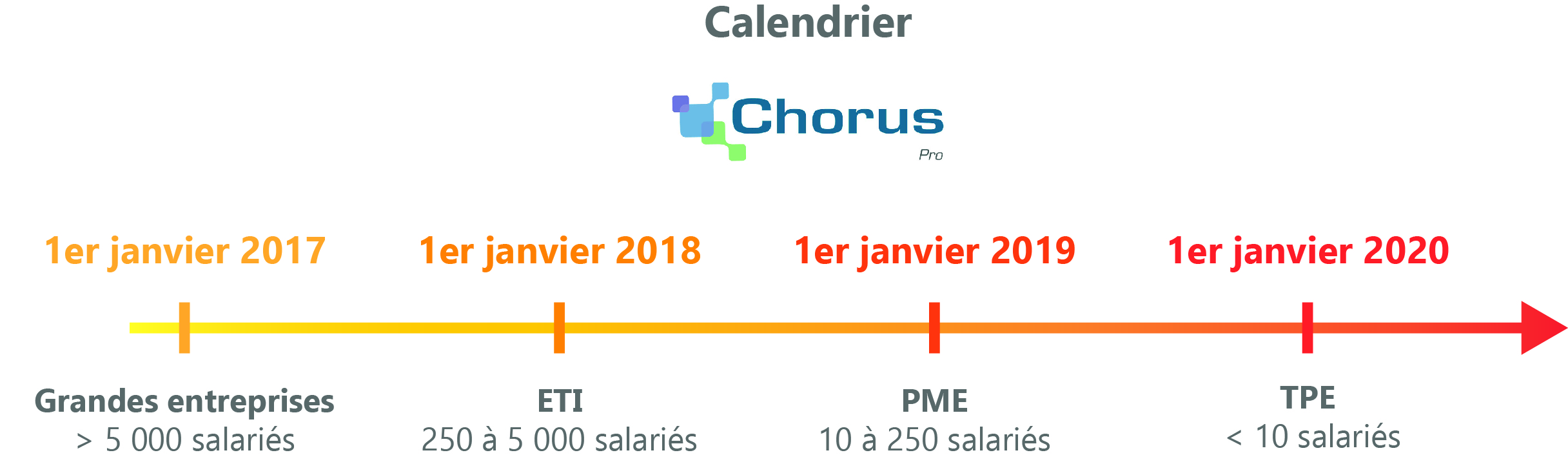

Depuis 2016, avec la mise en place du portail Chorus Pro (à la suite de l’évolution de la législation), l’utilisation de la facture électronique s’est généralisée dans les structures publiques. Depuis 2020, toutes les entreprises qui souhaitent travailler avec des structures publiques doivent travailler avec la facturation électronique. Chaque année, il y a donc de plus en plus d’entreprises qui adoptent ce mode d’échange de données sous forme électronique.

De plus, le contexte économique oblige à toujours plus d’efficacité. Les structures cherchent à répondre à des problématiques de performance et de gain de temps afin de mieux rentabiliser leurs activités. Dans la même lignée que les structures publiques, de plus en plus de clients font donc le choix de la facturation électronique. Le contexte actuel incite donc à la dématérialisation pour bénéficier de retours économiques immédiats. Or, pour plus d’efficacité, ces clients exigent et exigeront des fournisseurs une transmission des factures de façon dématérialisée.

Ainsi, de plus en plus d’appels d’offres demandent la dématérialisation de la facture. Pour remporter ces appels d’offres, les fournisseurs doivent donc s’adapter. Et plus ils passent le cap de la dématérialisation rapidement, plus ils seront compétitifs sur le marché. Afin d’améliorer la performance commerciale de leur entreprise, opter pour la facturation électronique est donc un avantage supplémentaire et un choix judicieux pour la compétitivité.

Vous l’aurez compris, pour le succès de votre projet, vous devez convaincre les fournisseurs de choisir de dématérialiser l’envoi de factures.

La facture électronique est une solution qui présente des avantages pour vos fournisseurs. Elle apporte une valeur ajoutée avec simplicité, tout en permettant de réduire les retards de paiements. C’est une technologie fiable qui améliore les relations client-fournisseurs, et permet aux entreprises de rester compétitives. Alors pourquoi s’en passer ?

Vous souhaitez passer à la facture électronique et offrir ces avantages à vos fournisseurs ?

Autres articles qui pourraient vous intéresser :

Partenariat Freedz & Aareon

Automatisez le traitement de vos factures en dématérialisant leur collecte et émission grâce à la plateforme Freedz et à son intégration automatique dans les progiciels PIH ou PRH de Aareon.Aareon, leader européen des systèmes d’information et solutions digitales...

Comment la pré-comptabilité vous aide à optimiser votre gestion financière ?

La tenue d’une comptabilité par l’entreprise répond non seulement à une obligation légale mais surtout à un besoin d’assurer une gestion financière pérenne et efficace. C'est à travers cette discipline que les flux monétaires sont enregistrés, analysés et interprétés,...

E-reporting : tout connaître sur l’obligation de transmission des données de transactions

Attendu – voire souhaité – par de nombreuses entreprises, le report de la généralisation de la facture électronique au 1er septembre 2026 ne doit pas être synonyme de relâchement par les parties prenantes. Il constitue plutôt une opportunité et du temps accordé pour...

Nos ressources gratuites les plus populaires :

Livre blanc : l'essentiel pour réussir la transformation digitale de sa comptabilité fournisseurs

Ce livre blanc apporte les réponses aux principales questions que vous vous posez au moment d’aborder le passage à la facture électronique, ainsi que les points de vigilance à avoir pour mener à bien votre projet.

Le Guide pour 2024 : tout savoir sur la généralisation de la facture électronique

Retrouvez dans ce guide toutes les informations nécessaires pour comprendre la nouvelle législation et anticiper ce changement.

Cas client : Améliorer l’efficacité de la comptabilité fournisseurs tout en gardant le contrôle

Afin d’améliorer ses relations fournisseurs et revaloriser les missions de ses collaborateurs au sein de la comptabilité, Halpades a fait le choix de la dématérialisation complète des factures fournisseurs grâce à Freedz.