4 expert tips to manage your cash flow effectively

Good cash management is not just a matter for large companies. In fact, smaller companies, SMEs, have just as much interest in acquiring solutions for monitoring and managing their cash flow.

But beyond the software part and the now indispensable digitalisation of all financial processes, efficient management of your cash flow also relies on good reflexes to be adopted from the beginning of your project. Decoding with Pandat Finance

Tip 1: Draw up a cash flow forecast

If you have an action plan for your business and have gone through the business plan process to set up your business, then you will not mind creating a new plan: the cash flow forecast. This is a table in which you record expected cash receipts and disbursements. By anticipating future movements that are already known or by forecasting certain operations according to the company's activity, you can avoid a cash flow shortfall. Above all, this plan makes it possible to forecast bank balances and thus never overdraw the company's account. It is also useful for knowing when to start looking for new financing.

Beyond the management aspect, a cash flow forecast is also a tool that simplifies your relations with banks. By having a summary of your lines of credit and expected cash inflows and outflows, you give your contact person solid information to help them make their decision. You show that you know how to anticipate!

Tip 2: Adjust payment deadlines and centralise invoice management

Good cash flow management also depends on good visibility of the payment terms you grant and the terms your suppliers or partners impose on you. The rule? Simplification. For your part, try to establish consistent payment terms that can be generalised to most of your partners. Tailor-made solutions with exceptional payment terms or any other special solution should remain the exception.

When it comes to managing your invoices, consider centralising them. There are now tools that can pull up the electronic invoices you need to honour so you don't miss a deadline and have a proactive view of your cash flow.

Tip 3: Maintain a good level of working capital

Learning how to maintain - or increase - the cash flow of your business is essential to ensure sustainability. Having sufficient financial capacity is essential to react quickly to unforeseen circumstances. This may be the case, for example, if demand in your sector of activity explodes, if a competitor disappears and increases the pressure on your business, etc. How can you maintain a good level of working capital? Start by getting the invoices you are owed paid quickly, while maintaining a good relationship with your customers.

There are also other technical solutions that relieve your cash flow and allow you to structure your business over the long term: long-term loans to increase working capital, refinancing of fixed assets or even personal contributions to finance working capital. It is advisable to have a personalised approach in this respect, with the advice of a specialist. These technical arrangements should not be dismissed out of hand. They can help you to mature as a decision-maker.

Tip 4: Invest your cash to maximise your return

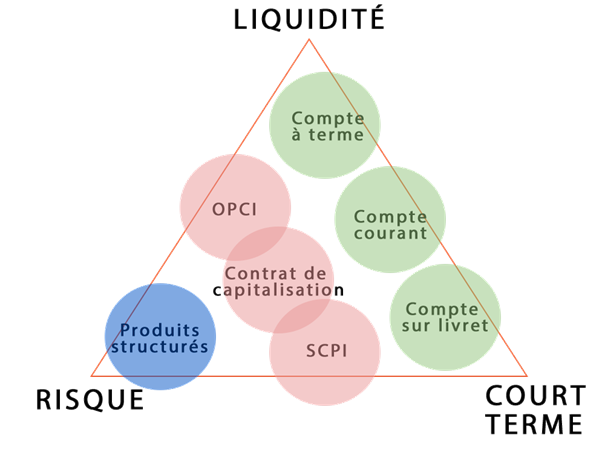

Good cash management also means knowing how to invest some of the money you have on hand in products adapted to your situation. But because the steps are sometimes perceived as cumbersome, between exchanges with banks and certain specialised organisations, companies tend to neglect cash investment . This is a mistake. Because from term accounts to capitalisation contracts or real estate products (SCPI, OPCI) there is a wide variety of solutions. Depending on the level of liquidity you need, the duration of your investment and your sensitivity to risk, there is an answer.

The banking environment of low interest rates and the relative timidity of many players do not help in making the right decisions. What are the investment solutions for your cash flow in the current context ? Pandat Finance Pandat Finance has published a guide that answers this question with a list of the best investments for legal entities, with high-performance secure solutions and concrete figures.

To manage your cash flow well, you need an expert's eye. Don't wait for problems to appear and don't be satisfied with a stagnant cash flow that doesn't bring you any problems but doesn't bring you any money either... Seize this question to accompany the growth of your project.

Freedz & Aareon partnership

Automate the processing of your invoices by dematerializing their collection and issue thanks to the Freedz platform and its automatic integration into Aareon's PIH or PRH software packages.Aareon, European leader in information systems and digital solutions...

How can pre-accounting help you optimize your financial management?

Keeping accounts is not only a legal requirement for companies, but above all a way of ensuring sustainable, efficient financial management. It is through this discipline that cash flows are recorded, analyzed and interpreted,...

E-reporting: everything you need to know about the obligation to transmit transaction data

Expected - even desired - by many companies, the postponement of the generalization of electronic invoicing to September 1, 2026 should not be synonymous with complacency on the part of stakeholders. Rather, it represents an opportunity and time to...

Our most popular free resources:

White paper: the essentials for a successful digital transformation of your accounts payable

This white paper provides answers to the main questions you may have when making the transition to electronic invoicing, as well as the points to watch out for in order to successfully complete your project.

The Guide to 2024: everything you need to know about the widespread use of electronic invoicing

This guide contains all the information you need to understand the new legislation and to anticipate this change.

Case Study: Improve Accounts Payable Efficiency While Maintaining Control

In order to improve its supplier relations and enhance the value of its employees' missions within the accounting department, Halpades has chosen to completely dematerialise its supplier invoices thanks to Freedz.